Hello Folks!

The year 2020 has been tough on us up till now. Everything seems to be so negative as if we can sense pessimism everywhere, be it in our Media, Bollywood, Markets or Economy! The only silver lining is, it has given us all an opportunity to introspect on our lives & this is going to help us a long way!

We know things happening around us are not perfect in fact they are scary at times which paints a gloomy picture of what future has saved for us!

This comes with Moody’s announcing a downgrade on India’s sovereign bonds from Baa2 to Baa3. Now, what it exactly means? Why was the downgrade done? Also, can we afford to ignore this downgrade just because now Moody’s has brought the rating down to the level at which S&P & Fitch had rated? Let’s find out!

Now first things first, Moody’s has downgraded the Long term “Issuer” ratings for foreign & local currency, Long term Senior Unsecured Debt (Local Currency) & even the Short term Senior Unsecured Debt (Local Currency). And the Outlook remains Negative.

Now, what is this all about?

It is more of a consequence of a bunch of factors including pre – COVID slower growth rates, concerns on policy implementations, raising issues in the Banking & Non – Banking Financial Services sector, Increased Debt & ESG (Environmental, Social & Governance) concerns. Let’s try to make sense out of this one by one.

Pre – COVID Slowdown: The GDP growth rates have been slowing down even before the pandemic kicked in, owing to slowing demand & other factors like weakening position in Real Estate, Banking & Non – Banking credit segments, etc.

The graph above clearly makes the point as the data of Annual Growth Rates till January 2020. Now it does not take a rocket scientist to say that the Pandemic is going to cripple this situation further. Amidst all this, the $5 Trillion goal is going to be delayed, as GDP numbers are unlikely to rise accompanied by the depreciation of INR!

The Industrial Production Growth also corroborates the story that we were anyways heading towards a slow-down & due to the corona virus contagion, India’s Industrial production fell by 18.3% on a year on year basis, steepest decline since 1994.

Policy Implementations: Another major reason of the downgrade was “Slow reform momentum and constrained policy effectiveness” & the rationale that the implementation of key reforms has been relatively weak and has not resulted in material credit improvements, indicating limited policy effectiveness. In other words, all new policies like GST, various programmes for MSMEs are taking a longer than expected time to yield the fruits. Political opinions aside, one should appreciate the fact that this is not entirely the fault of government, in many ways the government also has to express leniency towards the businesses when it comes to litigation & recovery of taxes; & a lot of reliefs have to be given because a lot of businesses in India still are unable to receive professional help to cope up with the new policies & of course the bureaucracy is to be criticized. If this is true, does that mean we should be unwelcoming to the new policies? Ofcourse not, as it has a lot to offer in terms of utility in the long term even though short to medium term targets are missed. That’s a whole point of being an “emerging economy” isn’t it?

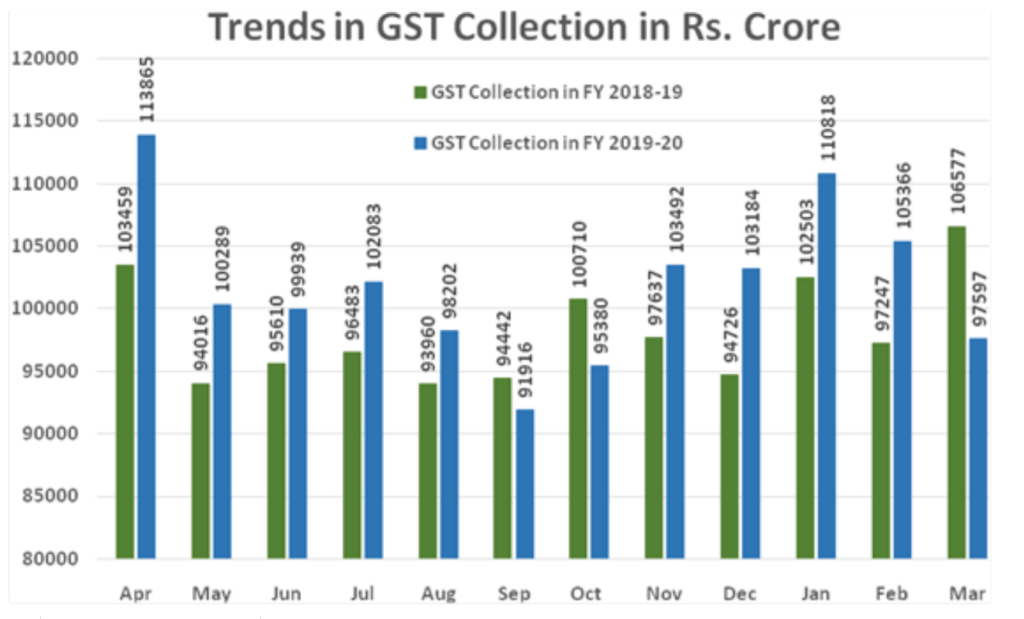

Source: Ministry of Finance

(GST revenues have shown a negative growth of about 4% in 2019-20)

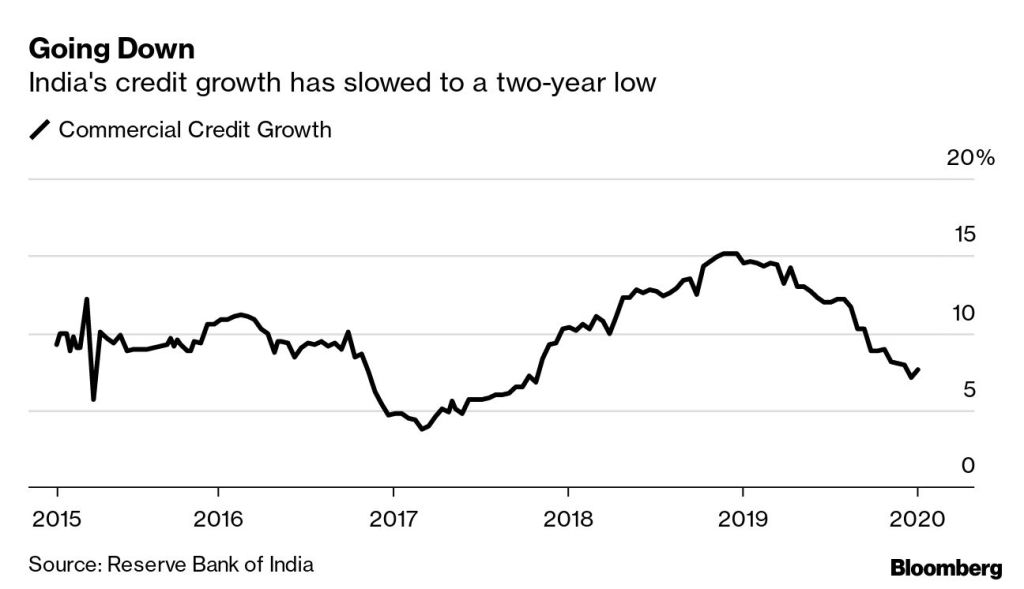

Banking & Non – Banking Financial Sector: Despite the liquidity in the financial system infused by various measures taken by the RBI, the Banks are not lending enough – which is not helping the businesses at all. Credit Risk is at its peak, the Banks & NBFCs have become increasingly watchful of lending to avoid new NPAs on their balancesheets.

Here, the RBI has played a pivotal role in contributing almost 8.01 lakh crores (38% of the total 20.9 lakh crore package) in the form of liquidity measures, TLTRO (Targeted Long Term Repo Operations) & rate cuts.

But for it to help the economy, Banks will have to lend more. Even the government has come up with schemes of guaranteeing some of the loans given by Banks. It would be interesting to see how it impacts the lending; and in turn, production.

NPA problems are not new to India, especially after the credit events, as that of the one happened with entities like IL&FS, Kingfisher Airlines, etc. Such issues are expected to become rampant in situations like the one’s prevailing at this time. Many prudent banks are setting aside thousands of crores of rupees in the form of provisions considering the tide of NPAs following the current COVID crisis. ∴ The MSMEs are still going to struggle for funding even though the Banks are flush with cash, as even the general interest rates go lower, credit spreads will continue to widen.

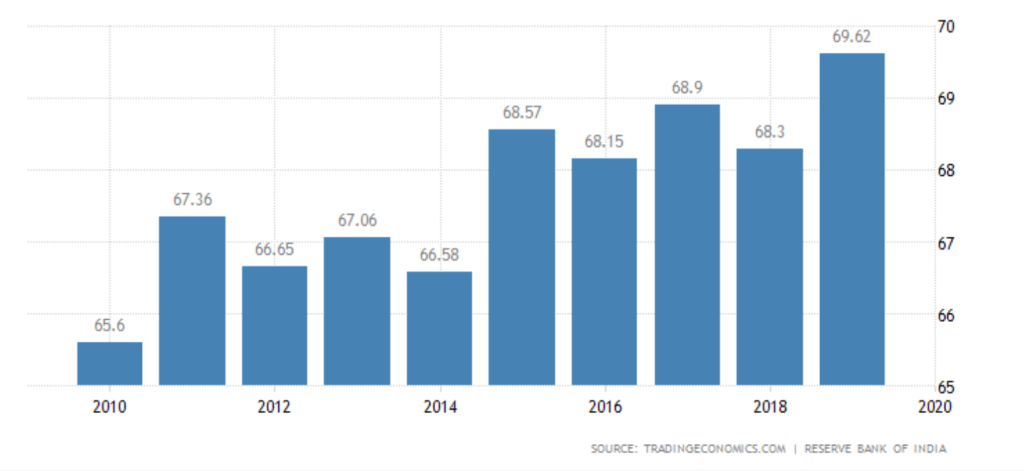

Increased Debt: It’s a no brainer that India’s Debt has been rising from the past couple of years, as we are adding on more debt as compared to what we are repaying, but the Debt to GDP ratio gives us a better perspective:

This becomes a problem especially in recessionary points like these, as the Debt – GDP ratio is generally considered as a measure of the country’s ability to repay its debts; and due to the slowdown, the GDP is not coming back soon, in fact CRISIL recently said in one of their reports that 10% of the GDP is permanently lost & the debt is going to rise due to slowing pace of tax revenues & increased expenditure due to the pandemic. Moody’s expects this figure to go as high as 84% of the Total GDP by the end of FY 2020.

Now let’s discuss why I have bolded the word “Generally” in the above statement, well that’s because normally, the debt – GDP ratio shows the country’s ability to repay its debt, but there have been cases where the debt – GDP has been very high, still the country is away from a default.

Like: Japan – 238% debt to GDP but its credit rating is still an A+, USA has a debt to GDP ratio of 106.9% & has a credit rating of AAA and Bonds issued by the US government are considered to be one of the safest!

However, there has been a study by the World Bank which says that a country with a debt to GDP greater than 77% for prolonged periods has a slowing growth. This is the concern.

One needs to consider such important macro-economic variables while analysing investment opportunities too, especially in times like these, as the businesses they are investing in, are also affected by the business environment which in turn has an impact due to the macroeconomic scenario at play. Economists put forth a lot of concerns about the recovery but Investors & Portfolio managers are seen to have an opportunistic view. This difference of views makes sense because after all, even though the Economy won’t have a so-called “V-Shaped recovery”, markets can. Markets are a leading indicator of the business cycle the economy is in, which means that markets can come back to a positive note before the economy will as Markets tend to discount the future.

So, all in all, it’s going to be interesting to look how the post – COVID market & economy is going to look like, how the businesses are going to be changed & the shift in the overall lifestyle of the people affecting the overall consumer behaviour as well!

Wish you all a safe time with sound holistic health in these tough times.

Remember, difficult times makes us even stronger!

Hope this was value-adding!